WASHINGTON — U.S. Secretary of Agriculture Sonny Perdue announced details of the Market Facilitation Program July 25. This is the second year for the program, which distributed 83% of its 2018 funds to soybean farmers. This year, payments target a wider range of commodities.

The program, which supports farmers impacted by tariffs, will distribute funds in three portions. Farmers can submit applications to their local Farm Service Agency offices July 29 through December 6, and the first payments will be made in August.

Payment rates

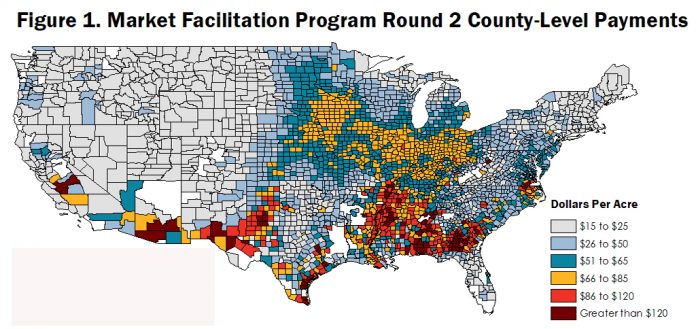

Non-specialty crop payment rates will be determined by county and by the farm’s total 2019 MFP-eligible crop plantings. The county rates will range from $15-150 per acre. A farmer’s total eligible plantings can not exceed total 2018 plantings.

For non-specialty crops, Ohio county rates range from $19-89 per acre. Pennsylvania county rates range from $15-71 per acre.

County payment rates including specialty crops and livestock are all currently available on farmers.gov.

Distribution

The first payment will be whichever is higher of either 50% of a farmer’s calculated payment, or $15 per acre.

The second and third portion, each 25% of the calculated payment, are not guaranteed and will be evaluated based on market conditions and trade opportunities. They will be made in November and early January, if conditions warrant.

MFP payments are limited to a combined $250,000 for non-specialty crops per person or legal entity. MFP payments are also limited to a combined $250,000 for dairy and hog producers and a combined $250,000 for specialty crop producers. However, no applicant can receive more than $500,000.

Eligibility

Eligible non-specialty crops include alfalfa hay, barley, canola, corn, crambe, dried beans, dry peas, extra-long staple cotton, flaxseed, lentils, long grain and medium grain rice, millet, mustard seed, oats, peanuts, rapeseed, rye, safflower, sesame seed, small and large chickpeas, sorghum, soybeans, sunflower seed, temperate japonica rice, triticale, upland cotton and wheat.

Non-specialty crops must be planted by Aug. 1 to be eligible.

Specialty crops including almonds, cranberries, cultivated ginseng, fresh grapes, fresh sweet cherries, hazelnuts, macadamia nuts, pecans, pistachios and walnuts are also eligible. Each specialty crop will receive a payment based on 2019 acres of fruit or nut bearing plants, or in the case of ginseng, based on harvested acres in 2019.

Dairy farmers who were in business as of June 1, 2019, will receive a per hundredweight payment on production history, and hog farmers will receive a payment based on the number of live hogs owned on a day selected by the farmer from April 1-May 15, 2019.

Eligible applicants must also have an average adjusted gross income for tax years 2014, 2015 and 2016 of less than $900,000, or 75 percent of the applicant’s average AGI for these years must have come from farming and ranching.

Applicants must also comply with the Highly Erodible Land and Wetland Conservation regulations.

Farmers who filed a prevented planting claim and planted an FSA-certified cover crop with the potential to be harvested qualify for a $15 per acre payment. Acres that were not planted in 2019 are not eligible.

2018 MFP benefits

Farmers who were ineligible for MFP in 2018 because they had an average AGI level higher than $900,000 may now be eligible for 2018 MFP benefits following changes required by the Additional Supplemental Appropriations for Disaster Relief Act of 2019. Farmers must be able to verify 75 percent or more of their average AGI was derived from farming and ranching to qualify.

This supplemental signup period will run parallel to the 2019 MFP signup, from July 29 through December 6, 2019.

More details

The MFP rule and a related Notice of Funding Availability will be published in the Federal Register July 29.

For more information on the program, visit www.farmers.gov/mfp or contact your local FSA office.