SALEM, Ohio — Farmers aren’t getting any younger, and student loan debt is one of the reasons why.

The National Young Farmers Coalition and nearly 100 other food and agriculture groups are campaigning to add farmers and ranchers to the Public Service Loan Forgiveness program. The U.S. House and Senate are both considering bills on the issue.

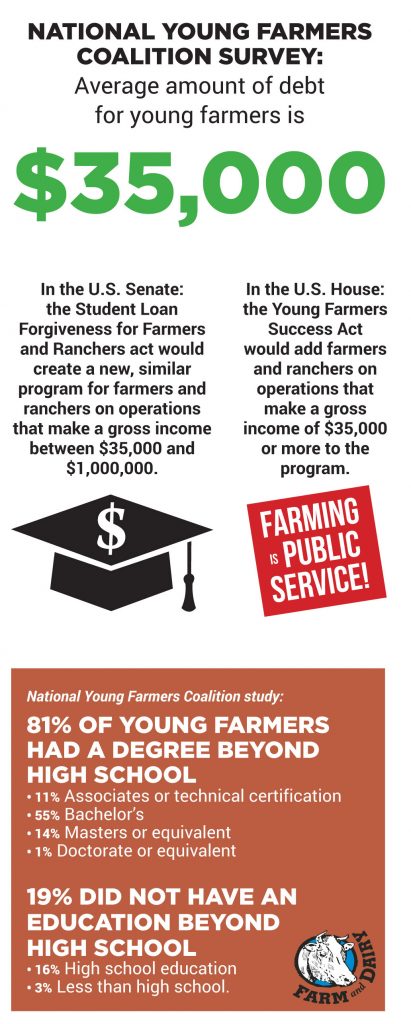

The average age of farmers is creeping toward 60, based on Census of Agriculture data. Studies by the coalition show student loan debt is one of the biggest factors keeping young, aspiring farmers out of farming, second only to land access, with the average amount of debt for young farmers at $35,000.

The coalition’s studies also show 81% of young farmers have some education beyond high school now — often an associate or bachelor’s degree.

Farmers that Sophie Ackoff, co-executive director for the coalition, has talked to believe their degrees are useful, but the cost of getting a degree can put a farming career at risk.

“Farming is a capital-intensive business,” Ackoff said. “Accessing credit for farming is already difficult.”

The campaign hinges on the idea that farming is a public service. Ackoff said farmers grow food, steward land and are good for local economies.

“Farmers aren’t going into it to make a lot of money, but to do something good for their communities and for the land,” she said.

Debt challenges

Ackoff said young farmers can benefit from a range of degree programs. Some study agriculture, but others study subjects like marketing, business and economics.

“Farming is a really complex profession and farmers are really asked to be so many different things at once,” Ackoff said. “We want people to be able to go to college and farm.”

Kelly Henderson, of Columbus, works as a PROSPER Prevention Coordinator for Ohio State University. She has a bachelor’s in horticulture and a master’s in agriculture education. Her family has a farm in Butler County, where they are transitioning management from her grandparents to her parents.

Between healthcare costs and student loan debt, Henderson is not sure that she’ll ever farm full time. She has 20 years left on her current loan repayment plan, and she knows the physical demands of farming will be more challenging as she gets older.

She graduated with about $35,000 in debt. Henderson noted that her high school post-secondary program allowed her to have some college credits paid for. She transferred in to Ohio State as a sophomore and lived and worked off-campus to save money.

Rachel Tayse, the Begin Farming Program coordinator for the Ohio Ecological Food and Farming Association, said many of the students in OEFFA’s classes have significant amounts of debt from student loans.

“We are seeing people come through our doors and not be able to choose farming as a career because of the loan costs,” Tayse said.

Current program

The coalition started its campaign to add farmers and ranchers to the Public Service Loan Forgiveness program in 2015 and has worked with lawmakers to introduce federal legislation on the program since then.

The current program can include people who work for government or tax-exempt, not-for-profit organizations. People in the program make 10 years of income-based payments before whatever is left of the loans is forgiven.

The idea is to allow people to pursue careers that provide a public service, but may not pay enough to cover the cost of their loans.

Legislation

The U.S. House bill, the Young Farmer Success Act, would add farmers whose operations make a gross income of at least $35,000 per year to the current program. Ackoff said setting this minimum income would benefit farmers who are producing food at a larger scale than hobby farms.

The U.S. Senate bill, the Student Loan Forgiveness for Farmers and Ranchers Act, would create a stand-alone public service loan forgiveness program for farmers and ranchers instead of adding them to the current program. Ackoff said there is less support for the current program in the Senate, so suggesting a new program made sense.

It also caps the amount of gross income a farmer’s operation could make while still being eligible for the program at a million dollars per year.

Ackoff noted that the House version did not include this cap because people in the program already make income-based payments for 10 years before having any loans forgiven, so farmers making more money would have less debt left to be forgiven anyway.

Impact of degrees

While many beginning and aspiring farmers have college degrees, it is hard to tell how much of a difference a degree makes in agriculture.

Ackoff said the coalition has not studied whether not having a degree puts young farmers at a disadvantage. She noted that it gives them fewer backup options if farming doesn’t work out.

Henderson doesn’t think degrees are always necessary to farm but believes her college experiences led her to agriculture.

“I probably wouldn’t be in agriculture if I didn’t have a degree,” Henderson said.

In college, Henderson’s professors encouraged her to take a year off to volunteer with Americorps in New Mexico, leading an outdoor gardening education program for high schoolers. The program led her to studying agriculture education.

Lauren Hirtle, of central Ohio, has a bachelor’s in anthropology and a master’s in fine art. She originally wanted to teach, but became interested in farming through an apprenticeship on a small farm connected to a school she worked with.

She worked seasonally and part time at multiple farms for years before getting a full-time job at an organic certifying agency to help pay off her student loans and save to start her own farm. The art skills she developed have allowed her to design logos, fliers and signs for farms.

“Using my skills in art is just another way for me to plug into the local farming community,” Hirtle explained.

Tayse said students in the Begin Farming program have a range of backgrounds, including degrees in environmental studies, human health, rural studies or sociology. Some students have no degree.

Others have an agricultural degree, but still need on-farm experience.

Tayse said while OEFFA has not specifically tracked her students’ educations, she has seen that “formal university education doesn’t necessarily make someone a better or a worse farmer.”

“We talk about resilience a lot,” Tayse said. “Farmers have to be really creative … in terms of being able to assess situations relatively quickly and having the practical skills.”

Practical experience

OEFFA’s Begin Farming program focuses on hands-on, practical experience for aspiring and early-career farmers, including one workshop that focuses on developing a business plan to start a farm.

“People come to us when they want on-farm experience and to hear the real-world story,” Tayse said.

“A lot of farmers are learning how to farm through on-farm apprenticeships, learning from other farmers, and that’s a really valuable experience too,” Ackoff said. “Being trained on-farm is important as well.”

Tayse said OEFFA’s board has not endorsed a statement on student loan forgiveness for farmers. She noted, however, that allowing some forgiveness would let more young people get into agriculture.