With skyrocketing feed prices and negative margins to dairy producers, it may seem as if 2009 is repeating itself. But I don’t think that this is the case — there is some sunshine showing up in the currently cloudy dairy skies.

The feed situation

It was not that long ago the USDA and most experts were forecasting a bumper corn crop in the U.S. Even early June’s forecasts were still bullish.

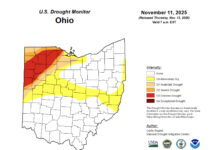

Then the bad weather news started to spread and soon we had the drought of the century.

My experience, however, has been that it is never quite as good as the reports would lead you to believe in the good times, and never as bad as what is being reported in the bad times. Somehow, things always seem to creep back toward the average.

On the feed side, we have already seen some of this already. The December corn futures that peaked well above $8/bushel in August have retreated to the low $7/bushel for a while and are now trading in the mid-$7 range.

Although this still presage of relatively high feed prices, it is somewhat better than was anticipated just a month or two ago.

The milk situation

This is where I see some rays of sunshine.

Because of our pricing system, prices received by producers for their milk always lag prices paid for the products made from the same milk. This is inherent in the system.

But this means that one can look at the direction taken by the four dairy product price drivers — cheese, butter, dry whey, and non-fat dry milk — to get a very good guess to what prices dairy producers will be paid in the next month or two.

California’s August cheese production was 3.9 percent below that of last August. We don’t have statistics for the national production in August yet, but this explains some of the actions that have recently taken place at the Chicago Mercantile Exchange (CME).

During the last week of September, the CME cheese prices rose by 10 cents per pound, settling above $2 per pound. This price strength is driven by strong domestic and export sales, weakening milk production, and the expectation of strong sales during the holiday season.

Likewise, butter prices on the CME continued climbing from the low of $1.30 in mid-May to $1.90-$2/pound now. Domestic demand is very strong.

The price range for non-fat dry milk was $1.40 to $1.65/pound, also up from recent prices. Dry whey is trading at nearly $60 cents/pound, or about three times the prices that whey was trading at just 10 years ago.

In a nutshell, all indications are that Class III prices should reach $20/cwt. shortly, and remain in the $19-$20 range for the foreseeable future (four to six months).

Historically, these would be considered very strong prices. Of course, we weren’t dealing with $8/bushel corn in other historic times…

The changing landscape

Ten to 15 years ago, the economic landscape of dairy farming was favorable to those who purchased their feeds and concentrated on the cows. The “Western style” of dairy production had a clear advantage when corn was selling at $2/bu.

Now the table has been turned and it is clearly evident that the “Midwestern style” of production is being advantaged.

Integrated dairy farms producing a large amount of the feeds consumed by their cows have a distinct cash flow advantage. This should be very good to Ohio dairy producers in the long run.

(The author is an Extension dairy specialist at Ohio State University. Questions or comments can be sent in care of Farm and Dairy, P.O. Box 38, Salem, OH 44460.)