The interest in leasing land for oil and gas production throughout eastern and southeast Ohio has been high, with expansion to northern parts of Ohio starting to occur. This expansion will change the lives of many farm families and communities for years to come, as large sums of new money make their way into the hands of families.

Understanding and implementing strategies to minimize your tax burden are important. The assistance of a qualified attorney and/or accountant is highly recommended.

Lease income: Cash payments, commonly referred to as bonus payments or up front payments, and typically paid on a per acre basis, are considered ordinary income for tax reporting purposes. Lease payments are reported on Schedule E of your tax return. You are not required to pay self-employment tax on the income you receive from lease payments.

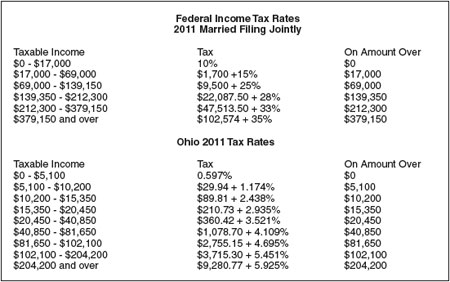

How much will I owe in taxes from my bonus payment? The answer to this depends upon your tax bracket. These payments are added to other income you have received to determine your tax bracket.

Currently, the highest federal income tax bracket is 35 percent, for those with an adjusted gross income (AGI) of $379,150 or higher. The highest Ohio income tax bracket is 5.925 percent, for those with Ohio taxable income over $204,200. When combined, these two equal 40.925 percent.

However, your actual taxable income will probably be lower because of how the tax is calculated. Your income tax is calculated for each tax bracket you pass through on the way to the 35 percent rate.

Tax management strategies: Making management decisions to minimize taxes is appropriate. Evading the taxes due is not a wise management decision and is illegal. Following are examples of available options to reduce your tax liability.

Attorney fees

In many cases, an attorney is hired to assist in negotiations. Payments associated with lease negotiation made to the attorney can be deducted.

Pre-paid expenses

Expenses such as feed, seed, fertilizer, and chemicals, among others are often purchased by farmers as pre-paid expenses. It’s important to follow specific rules for these expenses, including:

Pre-payments must be for a specific item or quantity of items at a specific price. Simply making a payment or deposit on an account and deciding later to what the payment is to be applied does not qualify.

Pre-payments must be for a business purpose and not just a way to avoid paying taxes.

Pre-paid expenses can be no more than 50 percent of your total other deductible farm expenses.

Retirement plans

Contributions to a retirement plan may lessen your tax burden, but there are limits as to how much can be contributed. There are also particular rules about taxes on these funds. Seek the advice of a qualified financial planner to determine the benefits and limitations.

Charitable giving

Contributions made to qualified organizations, those that have 501(c)3 status, churches, and other qualified organizations can help lower your tax bill. Contributions must be equal to or greater than the applicable Standard Deduction. For donations of $250 or more written confirmation is required.

Purchase of assets

Because of depreciation, purchasing assets simply to reduce your tax liability may not be the best use of your cash. Evaluate your current situation to determine if purchasing assets is appropriate. Utilize Bonus Depreciation/Utilize Section 179 Expensing See the IRS Publication 225 Farmers Tax Guide for specifics.

Farm repairs

For many, this new money can help pay for those repairs you’ve been wanting to make, but didn’t have the extra cash to do so.

Real estate taxes

Making payments that will be due the next year by Dec. 31 of the year of high income is recommended.

Ohio and local estimated income taxes

Making estimated payments for the tax that will be due at filing time by Dec. 31 in the year of high income will result in a greater deduction of the federal itemized deductions.

Debt payment. Unfortunately, payments of principal on loans are not deductible. The only part that is deductible is the interest portion.

Conclusions: For farmers who negotiate a lease of their oil and gas mineral rights there is the potential for significant income. It is suggested that landowners seek the assistance of a qualified attorney and accountant to minimize their tax liability.

Great Article. Thanks for the info, super helpful. Does anyone know where I can find a blank form Schedule E to fill out?

Hi Christian,

The IRS website has information about Schedule E forms here: http://www.irs.gov/uac/Schedule-E-(Form-1040),-Supplemental-Income-and-Loss.