For some farms, a nice Christmas gift arrived Dec. 8 when the U.S. Department of Agriculture’s Farm Service Agency announced sign up for the 2022 Dairy Margin Coverage Program and the Supplemental Dairy Margin Coverage Program. Sign-ups began the 13th and will run through Feb. 18, for both programs at your county’s Farm Service Agency office.

Supplemental program

The potential Christmas present is the new Supplemental Dairy Margin Coverage program, which provides a window of opportunity for small to medium-sized farms who have substantially increased production in the last 10 years.

The program sets a farm’s production history as the highest of annual milk sales for 2011, 2012 or 2013. Farms that participated in the past would have received modest production history “bumps” reflecting annual U.S. production increases.

If the farm’s production history is less than 5 million pounds per year, this is the opportunity to increase the farm’s production history up to 5 million pounds based on milk sold in 2019. We first heard about this program early in 2021, with indications that it would be available for qualifying farms that had purchased 2021 coverage.

It is available for qualifying farms for 2021, but farms must apply for the Supplemental Coverage Program and purchase coverage for the additional qualifying 2021 pounds before signing up for 2022 coverage.

2021

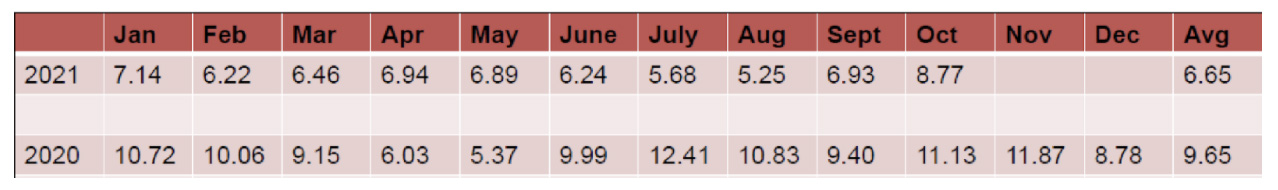

The program has been very effective in helping dairy farms navigate low milk prices and high feed prices in 2021, with announced margins triggering indemnities at some level each month.

In 2020, indemnities were triggered in five of 12 months. Margins are the difference between the US All-Milk price and a feed cost equation.

Farms have the opportunity to purchase coverage for margins from $4 to $9.50 per hundredweight, with premiums increasing for higher levels of coverage. So, if a farm had purchased coverage at the $9.50 level, October 2021 would have triggered an indemnity of 73 cents ($9.50 – $8.77) per hundredweight for 1/12th of the covered production history.

In Ohio, 739 farms enrolled 3.58 billion pounds of production history in 2021, 213 more farms and 830 million more pounds than were enrolled in 2020: a good management move.

Farms that have never participated in the Dairy Margin Coverage program can sign up now through their FSA offices. To see what different options will cost, visit dairymarkets.org and use the calculator to look at different coverage options and premium costs. Supplemental production history pounds will be charged the full premium rate for the coverage selected.

One more change

The final USDA announcement was the adjustment for alfalfa hay in the feed cost formula. Previously, the cost of the alfalfa hay component was based on 50% regular alfalfa and 50% premium alfalfa. The formula will now use 100% premium alfalfa.

This change is retroactive to January 2020 and margins will be recalculated back to that month. Adjustments in indemnities to participating farms will be automatically generated and sent to the farms.

One final note

This program was initiated as the Dairy Margin Protection Program in the 2014 Farm Bill. This signaled the end of the dairy price support program which had been in place for decades. No one had to sign up for the program; it was a safety-net style program for all.

Now, the emphasis has changed from safety-net to protecting a margin. Farms must sign up to participate. Updates to the program now known as the DMC program have greatly enhanced its effectiveness for farms participating at higher coverage levels (margins of $8.50 to $9.50 per hundredweight).

Risk coverage

Other tools are available for dairy managers to use such as futures, options, forward pricing, livestock gross margin insurance and dairy revenue protection insurance. All of these take time to study and make (frequent) decisions, update selections and usually cost money.

The Dairy Margin Coverage program also takes some time to study and make a decision each year. However, once that decision is made, it is done for the year. Premiums are favorable for farms with production history under 5 million pounds — generally 250 cows or less.

Consider this opportunity as you look to manage milk and feed price risk for 2022. The best thing that can happen is that you have some coverage, and no indemnities are triggered. But when years like 2021 happen, it is good to have some risk coverage.