WOOSTER, Ohio — The softening grain prices have put some downward pressure on farmland values this year — although not as much as you might expect.

While grain prices decreased significantly, land values are actually up — at least in Ohio, Michigan, West Virginia and Indiana.

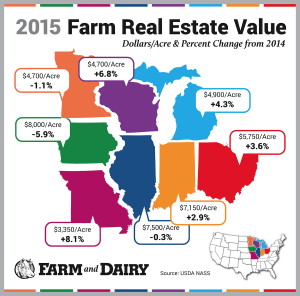

Farm real estate values (land and buildings), increased by 2.4 percent across the United States — but the rate of increase is considerably lower than the previous five years, according to an Aug. 5 report by the U.S. Department of Agriculture’s National Agricultural Statistics Service.

On a national level, farm real estate is averaging $3,020 per acre, compared to $2,950 per acre in 2014, $2,730 in 2013, and $2,300 in 2011.

State level

In Ohio, farm real estate values are up 3.6 percent over last year, at $5,760 per acre, and Ohio’s cropland value (without buildings) increased 3.5 percent, to $5,850 per acre.

But the increase is less than half of the increase from 2013 to 2014, which was nearly 9 percent; and the 2012 to 2013 increase, which was just under 10 percent.

In Pennsylvania, farm real estate actually decreased by about 1.8 percent, to average $5,500 per acre, but cropland increased by one percent, to reach $5,900 an acre.

As expected

Barry Ward, an ag economist with Ohio State University and leader of Production Business Management with OSU, said he’s not surprised at the results. He had predicted a softening of land prices at the onset of the year, due to lower returns from crops.

“I think it’s consistent from what we’ve been hearing from appraisers and auctioneers,” he said.

Ward said land prices may decrease further as the year comes to a close.

Related: Read the full U.S. farmland values report

But on the flip side, values in Ohio are still up over the previous year, compared to the rest of the Corn Belt, which actually saw a .3 percent decrease, according to NASS.

Last year, most farmers had a good crop, Ward said, and the majority of farmers “still have very solid balance sheets.”

The years of 2006-2013 were good for grain farmers, and many still have significant equity saved, Ward said, which has allowed them to continue purchasing land.

And while grain prices are down, some livestock prices are up, with strong demand and lower feed costs. This is leading some producers to expand their herds and invest in new facilities — which, in turn, is putting upward pressure on some farm real estate values.

Banking trends. The Federal Reserve Bank of Chicago reported a 3 percent decrease in ag land values within its district, compared to a year ago. And the St. Louis branch, which includes Indiana, Illinois and Kentucky, reported that quality farmland values remained steady during the second quarter, after dropping sharply in the first quarter.

According to the St. Louis branch, however, the majority of lenders surveyed “expect quality farmland to decline in the third quarter.”

The St. Louis branch is also seeing a decline in cash rents for farmland, which fell 6.4 percent during the second quarter of 2015, compared to a year ago.

Ohio market

Dave Kaufman, an auctioneer with Kaufman Realty & Auctions, said the demand for Ohio land continues to be strong — whether it’s farmland, woodland or recreational land.

“On the long run, land prices are strong,” he said.

His auction company sells land throughout Ohio, with offices in Holmes and Tuscarawas counties. The strongest sales have been in Amish communities like Mount Hope. Some of that land topped $20,000 an acre, he said.

Part of the reason for strong land sales, he said, is because “people are looking for places to park money.”

Interest rates for savings accounts and CDs are at historical lows — while the stock market continues an up-and-down cycle.

Other factors

Another factor is supply and demand. Farms don’t go on the market often — and when they do, the neighbors often have an interest.

He’s also seeing strong demand for recreational land, which people buy for the woodlands, hunting or other hobbies.

Kaufman said the shale-gas influence has “tapered off drastically” in counties where drilling has yet to take place. But he said the money from drilling and leasing have likely helped the buyers of land.

For farmers looking to buy more land to farm, they’ll need to be prepared for tight margins, Ward said, and near break-even prices.

Looking at futures prices, there doesn’t look to be much relief in sight.

“Growers are going to just have to continue to be very creative,” Ward said.

Difficult times

He expects crop input prices to remain high, which will force farmers to think critically about land and farm machinery purchases, and whether to buy used machinery instead of new.

He said farmers will also need to look at what they’re paying for rent, and see if they can re-negotiate a price that’s closer to today’s tight margins.

But getting landlords to lower rent isn’t easy, and land rents in general often lag behind the changes in land values, Ward said.

“We haven’t seen enough evidence of lower rents to give us much relief on the cost side,” he said.

Ward and other OSU ag economists will be discussing the tight road ahead at this year’s Farm Science Review, during the Question the Authorities sessions, and elsewhere.

Related coverage:

Boom or bust? Farmland values continue to rise (June, 2013).